Total Inventory Cost Formula

One of the major issues is that its calculated based on the Ending Inventory Balance Ending Inventory Balance The ending inventory formula computes the total value of finished products remaining in stock at the end of an accounting period for sale. The unsold inventory represents the cash blocked which if not invested in buying inventories then could have generated a return at the rate of the cost of capital Cost Of Capital The cost of capital formula calculates the weighted average costs of raising funds from the debt and equity holders and is the total of three separate calculations weightage of debt multiplied by the.

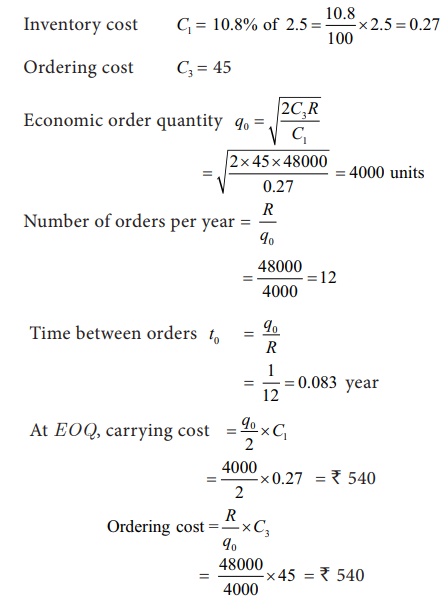

Economic Order Quantity Eoq Applications Of Differentiation Maxima And Minima

However as soon as such goods are sold they become a part of the Cost of.

. Let us consider a simple example where the total cost of production of a company stood at 5000 for the production of 1000 units. The average inventory is thus a mathematical calculation. Finally divide the result into your.

Your business has 10000 in inventory at the start of the year You buy 9000 in new products during the year. The EPQ model was developed by EW. Lets take the example of company A which has a beginning inventory of 20000.

Terms Similar to. You can calculate the cost of materials by measuring your inventory before starting production. Now let us assume when the quantity of production is increased from 1000 units to 1500 units the total cost of production increased from 5000 to.

The resulting number is the total cost of your direct materials. The average inventory is the mean value that can be different from the median value of an inventory during a determined period of time. It estimates on average the value or the number of goods stored.

Add additional purchases to this original number and then subtract your ending inventory to account for items that werent necessary for the project. Heres the formula for direct. So the cost of goods that are not yet sold but are ready for sale can be recorded as inventory asset in your balance sheet.

Below is the formula to calculate the average inventory. The company purchases raw materials and uses labour to produce goods that it sells and the total value for the same is 5000. At the end of the accounting period the company had 500 units left meaning it sold 1500 units.

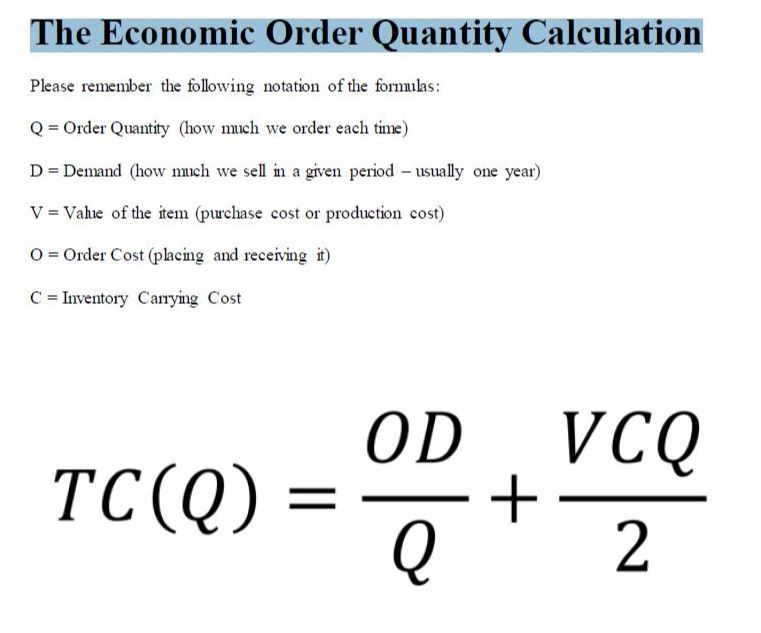

Cost of Goods Sold Formula Example 1. Issues with Average Inventory Formula. The economic production quantity model also known as the EPQ model determines the quantity a company or retailer should order to minimize the total inventory costs by balancing the inventory holding cost and average fixed ordering cost.

Food cost percentage formula. Total inventory turnover is calculated as. Food Cost Percentage Beginning Inventory Purchases Ending Inventory Food Sales.

The 5 turns figure is then divided into 365 days to arrive at 73 days of inventory on hand. To calculate your food cost percentage first add the value of your beginning inventory and your purchases and subtract the value of your ending inventory from the total. Total food sales.

Calculate actual food cost for the week using the following food cost formula. Ending Inventory 16000. AI is the average.

The first set of units purchased cost 10000 1000 x 10 and the second set of units purchased cost a total of 15000 1000 x 15 for a total of 2000 units and 25000 spent on new inventory. Per Unit Product Cost Total Cost of Direct Materials Total Cost of Direct Labour Total Cost of Direct Overheads Total Number of Units. The dollar value of your sales for the week which you can find in your sales reports.

8150000 Cost of Goods Sold 1630000 Inventory 5 Turns Per Year. To calculate the cost of goods sold use the following formula. Beginning Inventory 15000.

Beginning inventory net purchases or new inventory - ending inventory COGS. It is evaluated by deducting the cost of goods sold from the total of beginning inventory and. Heres what this formula looks like in practice.

Check out the example below to see this food cost percentage formula in action. This method is an extension of the economic order quantity model also known. The related information is 8150000 of cost of goods sold in the past year and ending inventory of 1630000.

Independent Demand Inventory Management Prezentaciya Onlajn

Chapter 12 Independent Demand Inventory Management Prezentaciya Na Slide Share Ru

Solved Please Answer Question 3 4 Amp 5 3 For Chegg Com

Prepaired By Hashem Al Sarsak Supervised By Dr Sanaa Alsayegh Ppt Download

0 Response to "Total Inventory Cost Formula"

Post a Comment